In the world of crypto, few terms are used more frequently than “decentralized exchange.” But despite countless brands and DAOs adopting it as a buzzword, few actually take the time to explain it. And knowing what a DEX is can be essential if you intend to use cryptocurrencies for things such as online gambling. That’s exactly why we felt an elaboration was in order.

Today’s blog intends to tackle all the myths, misconceptions and uncertainties surrounding decentralized exchanges. In addition, we’ll discuss what’s a DEX, how it works and why it benefits your activities at casino sites. Let’s start off with the basics.

What is a Decentralized Exchange (DEX)?

A decentralized exchange (DEX) is a place where individual users can trade cryptocurrencies in a non-custodial manner. What does this mean, exactly? Well, when you send money through a bank or an eWallet, that money is temporarily held by the bank/eWallet, i.e. they have custody over that money.

At a DEX, all transactions are peer-to-peer - you send your crypto to another wallet, and the person receives the funds. No third party has access to your wallet keys, nor will the DEX be able to access your funds in any way.

The goal of DEXs is to provide individuals with a safe way to acquire cryptos, but without the meddling of payment processors, banking institutions and brokers. As such, a DEX can be seen as the realization of Satoshi’s vision for the crypto world of the future. Today, DEXs are a part of the decentralized finance (DeFi) movement, which seeks to democratize and facilitate the investment and use of cryptos.

And the idea seems to be catching on, too. In 2020, DEXs saw $115 billion in traded funds, whereas the number ballooned to $1 trillion in 2021.

How Does a DEX Work?

Compared to centralized exchanges (CEXs), DEXs don’t allow users to swap fiat currencies for crypto, nor do they offer features such as margin trading or putting limit orders on your positions. This is because all of these features require the direct involvement of an organization or another type of third party.

CEXs facilitate trades by using something that’s called an order book. It’s a digital history of all the trades involving a certain coin. By harnessing this data in real time, the CEX determines the coin's price.

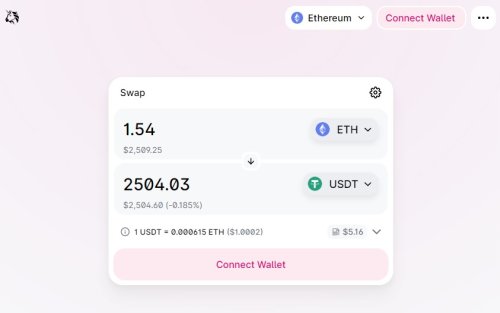

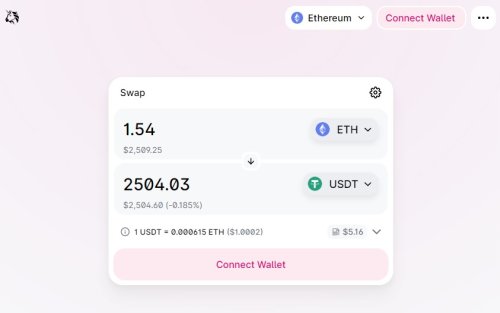

On the other hand, DEXs utilize smart contracts. These programs use a proprietary algorithm to create currency pairs for every pair of cryptos on the platform and establish a price relationship. In addition, a DEX often relies on its liquidity pool, a fund in which individual investors deposit their cryptos in exchange for interest. This helps DEXs resolve buy and sell orders immediately - investors get paid for fronting the funds, while traders get access to instant liquidity.

It’s also worth noting that all DEX transactions occur on the blockchain and are settled there. CEXs, however, often keep data in internal databases. This lack of transparency results in a high level of risk, especially when it comes to theft and market manipulation.

DEXs don’t just have a public record of transactions; they’re also created using open-source code. Anyone curious can take a look to ensure that there’s no malware in the program. Additionally, anyone can also take the code and modify it as they please. That’s how Uniswap gave birth to Pancakeswap, Sushiswap and all the other ‘swaps.’

Types of Decentralized Exchanges

The truth is, most DEXs resemble one another. Staking, interest and security are the calling cards of most of them, with the biggest differences often relating to implementation. However, industry experts agree that you can divide DEXs into two groups based on how they execute orders:

Order books. Any electronic exchange, crypto or otherwise, is based on its collection of buy and sell orders. However, implementing it is notoriously difficult when transactions are settled on the blockchain. Any interaction between orders within the book itself must be recorded on the chain. This makes the DEX prone to liquidity issues and high power consumption. As such, order book DEXs like Serum and 0x are few and far between.

Automated Money Makers (AMMs). The most common and most efficient type of DEX. Instead of using a book to match buy orders with sell orders (and vice-versa), AMMs draw upon a liquidity pool. The pool itself is formed by users giving their cryptos to the DEX in exchange for an interest. Because of it, all transactions are instant, and there’s no waiting for hours or days to find a buyer/seller.

Benefits of Using a Decentralized Exchange in the iGaming Industry

With crypto making a big impact on the gambling industry, online casinos have emerged as an unlikely but efficient way to play. Many metaverse venues, as well as traditional sites, accept crypto nowadays. You can use a DEX to quickly acquire the coins that you need. If you’re holding BTC, ETH or another ‘high profile’ coin, it might be best not to spend it all.

At a DEX, players can swap for another crypto, preferably one that they don’t view as an investment vessel. It’s best to play with less valuable or utility coins and use the exchange to swap your winnings back into BTC or ETH.

Another thing that’s often brushed over is the impact of smart contracts on financial planning. Since DEXs use them to determine exchange rates, they’re a great way to get a realistic view of the pricing. Players often get confused about the exchange rate, resulting in lost money and confusion.

The investment side of DEXs is also appealing to casino players, especially the staking. It’s become even more popular in the current financial climate. Banks are neither trustworthy enough nor willing to pay a reasonable interest rate. That’s not a good place to store your winnings. With a DEX, you can keep that money from yourself while passively earning through interest.

Be wary, though. Many scams have been uncovered in the last few years. To prevent yourself from being defrauded, conduct research on any DEX that seems interesting to you. Read about the creators of the project and analyze the whitepaper. Good luck!