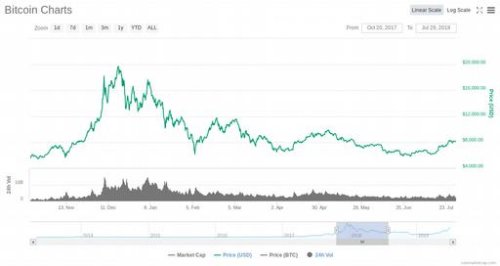

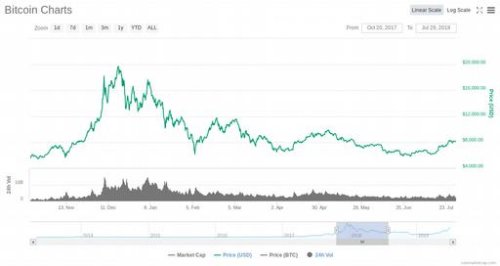

Two years after the major hype rally of 2017, Bitcoin is once again trending.

Compared to 2017 though, there are a couple of important differences that could hint to a new high and a new wave of adopters eager to use this disrupting technology.

Most importantly, awareness is at a different level compared to the two rallies. In 2017, very few people knew about cryptocurrency in general and most started noticing Bitcoin at its peak, in December. Two years later, main street and Wall Street for that matter keep a close eye on the market with futures and other types of crypto-based derivatives rolling on at full steam. The world will be much more willing to embrace the blockchain technology once it takes off.

Bitcoin For Online Payments

Does it mean Bitcoin is the future of online payments? Well… yes, but it doesn’t mean it will be the only option the Internet user will have to pay for goods & services online. Most definitely, it will be a viable option and a disruptor for all the payment processing industry.

Till then, however, we still have to think about the present and ponder if we can actually rely on Bitcoin & other cryptocurrencies for online payments in general. Unfortunately, the answer is not that easy mainly because digital currencies have some glaring downsides… for now, at least.

High Volatility

The most obvious downside is volatility.

Money by definition MUST be a stable means of exchange. Bitcoin is most definitely NOT. In a matter of almost two months, the value of the digital currency tripled. Last year, the value decreased to over 80%, compared to the all-time high reached in December 2017.

There will still be days when Bitcoin will fall off a cliff by 20% after a dream rally of 30%. This is a standard behavior all nascent assets go through in the price discovery stage.

Can you use Bitcoin at such a stage to play your favorite online casino games, for example? Of course, you can, but are you comfortable with it? Can you click the buttons fast enough to not witness a 5% spike downwards and be forced to use more bitcoins to buy a certain good with a fixed fiat-based price?

Not That User-Friendly (So Far)

Another aspect that could turn the Internet user away from actually using a cryptocurrency is the lack of a user-friendly, fairly secure layer to interact with.

Sending Bitcoin securely, from one address to another can be a painful experience and because of that, mistakes can and most probably will be made… mistakes that could cost the user real value. Furthermore, transferring funds can be time-consuming, especially if the user doesn’t know how the fees work. All merchants will ask for a number of confirmations (usually 3 in Bitcoin’s case, that can take around 30 minutes or more, depending on the network’s congestion) before sending you the product your way.

This is again natural since we mustn’t forget we are still dealing with a new technology born just ten years ago. Progress has been made and will be made for sure to the point where all users - no matter their IT knowledge - will enjoy the features Bitcoin has to offer.

Limited Adoption Among Merchants (So Far)

While you may know how to use Bitcoin comfortably, you won’t find that many online shops accepting cryptocurrency, unfortunately.

Indeed, more and more merchants add Bitcoin & altcoins as a payment option for their goods & services; nevertheless, the Internet is still far away from actually adopting the blockchain-based digital money.

As a result, what can you do if your online shop doesn’t accept virtual currencies, yet you want to spend your bitcoins? Moreover, what are the options if your favorite online casino only accepts deposits in fiat?

Using Bitcoin With eWallets

You could try out the emoney online exchanges that can help you exchange Bitcoin for your ewallet money, whether it’s PayPal, WebMoney, or ecoPayz.

Or, to avoid complications that could arise from using exchanges operating in grey markets, you could exchange the easy way, 100% legit, using ewallets like Skrill & Neteller.

Since they are part of the same conglomerate - PaySafe Group - both online payment processing services offer the option to buy and sell Bitcoin instantly, using a friendly interface. You can also trade your Bitcoin Cash, Ether, Ethereum Classic, EOS, XRP, or Stellar XRM with no additional verification required.

With this option at hand, you can fully enjoy the wide adaption ewallets such as Skrill & Neteller have, whether it’s food, fashion, electronics… you name it. No need to search for a Bitcoin-friendly shop, just find a merchant that accepts Skrill and/or Neteller & you’re good to go.

With online casino, your search is even easier. Since most popular casino websites accept Skrill and/or Neteller, you will have the unique possibility to use your Bitcoin & other cryptocurrencies for some good old adrenaline-based fun.

The Future Is Now!

With ewallets like Skrill & Neteller, you don’t have to wait for the future and the exponential adoption blockchain is promising to the world. You can now easily buy & sell Bitcoin, plus a handful of other major altcoins by just accessing your Skrill/Neteller account and taking advantage of their familiar, user-friendly interfaces.

Be sure to check our ewallet reviews to find out more and start spending Bitcoin now!